When you start enjoying your golden years, getting your Social Security benefits at the right age can make all the difference. Around 50% of Americans rely on Social Security for most of their income. A few things will influence how much money you’ll get, so let’s learn more about them.

Why Social Security Matters

According to research, many seniors rely on Social Security as a major part of their budget. If you’re looking ahead, understanding the importance of this paycheck can help you figure out how to increase what you’ll get later on. It’s worth thinking about how to make the most of it now before you hang up your work boots for good.

What Determines Your Social Security

The amount you get from Social Security depends on how much you’ve earned over your career and when you choose to start collecting your benefits. The more you’ve earned, the higher your Social Security check will be. Similarly, if you start claiming your checks later, you’ll get larger ones than if you claimed early.

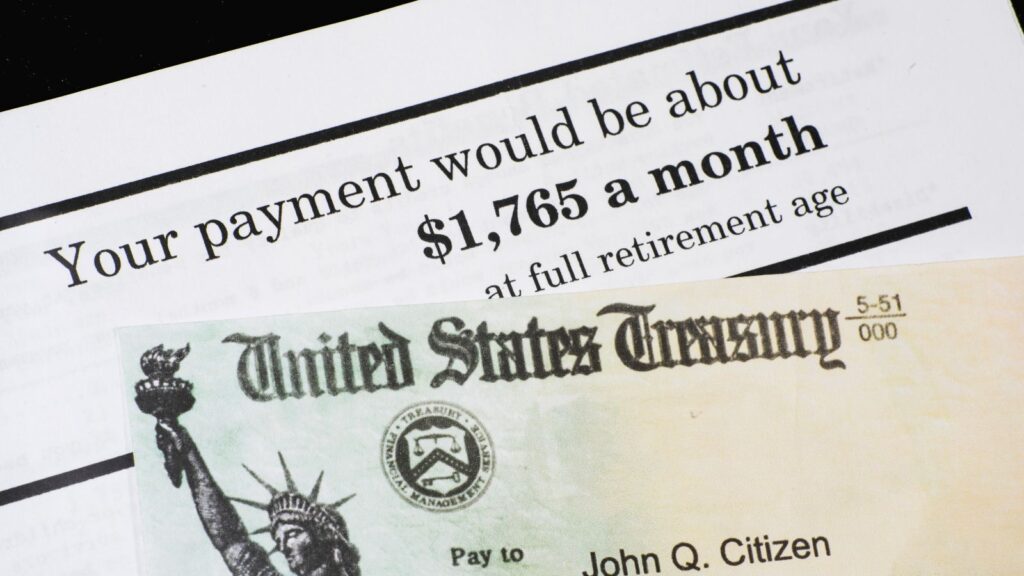

The Lowdown on PIA

Your monthly Social Security check is based on your 35 highest-paid years, which the government averages out and puts into a formula to create your Primary Insurance Amount (PIA). Your PIA is your starting point for benefits if you claim them at “full retirement age.” This figure is usually somewhere between 66 and 67.

Full Retirement Age Explained

If you know your full retirement age, you can plan better, as claimed before or after this age can either decrease or increase your monthly checks. Understanding yours will help you make more informed choices about the best time to draw on those funds. We can’t tell you when to start, though, and you’ll have to decide yourself.

Age Matters

The amount you get from Social Security can vary quite a bit, based on when you decide to take it. Pulling the trigger at 62, 66, 67, or 70 will lead to different financial outcomes, and each option has pros and cons. Whatever choice you make will seriously affect your retirement lifestyle, so put some time into making the right choice.

The Early Bird’s View at 62

Claiming your Social Security at 62 can give you an early start on benefits, but it’ll shrink your monthly check. For many people, the temptation of early access doesn’t outweigh the negatives of potentially tighter monthly budgets. If you’re considering doing this, consider your immediate needs and the long-term benefits.

The Perks of Waiting Until 70

Holding off on your Social Security claims until you’re 70 can significantly increase your monthly benefit. This increase can make a big difference, especially if you don’t have a lot of other retirement funds. It’s a good idea for those who can afford to wait, as the increased payout can really take off some financial pressure in those later years.

How Earnings Caps Affect You

Each year, a maximum amount of earnings counts towards your Social Security; for 2024, it’s $168,600. If you make more than this, the extra doesn’t count towards Social Security, but hitting this cap consistently can mean a larger retirement check. Keep an eye on this cap to better plan your earnings and contributions throughout your career.

Stacking up High Earnings

If you manage to earn above the Social Security cap for a good portion of your career, you’re likely to get the maximum benefits from your check. It’ll also strengthen your financial base for anything else you want to do during retirement. Essentially, it’ll be a win-win situation for you and your earnings.

Tracking the Earnings Cap

You should also check out how the earnings cap has changed over the years to understand these trends and plan your career earnings around maximizing your Social Security benefits. Researching earnings cap history may help you to anticipate future changes. As such, you’ll be able to adapt your financial decisions accordingly.

Social Security vs. Stock Market

Some retirees would rather invest more money in the stock market than claim Social Security early. Of course, it’s a gamble because you don’t know if the market will do better than the guaranteed increase from delaying Social Security. Making such a decision depends entirely on market performance and your personal risk tolerance.

Delaying Social Security

Putting off your Social Security claim means your benefits will grow about 7.4% each year, which is pretty good compared to the average ups and downs of the stock market. This guaranteed increase means you’ll have a higher steady income later. This could be a major advantage if you’re looking for more stability in your financial planning.

The Gamble of Waiting

Of course, delaying your Social Security benefits will increase your monthly take, but it also carries the risk of not living long enough to enjoy it. While it’s a conservative risk, it might be worth it for people with other savings. You’ll need to assess your health and financial situation to decide if this gamble makes sense.

Maximizing Wealth With Social Security

One study found that waiting until 70 to claim Social Security meant more money in the long run for most retirees. Only a small fraction in the study found they did better by claiming earlier. As such, it seems that patience really can indeed pay off, especially if you’re in good health and can afford to wait a few extra years.

Wealth and Waiting

Your overall financial health can play a big role in how you approach Social Security, and more money saved up means you might benefit more from waiting a bit longer to claim. Maximizing your benefits now will help your finances for the years when you’ll need it most. Whatever you choose, it’s not a decision to take lightly.

Inflation and Your Benefits

You’ll also need to think about how inflation could affect the value of your future Social Security checks. Inflation may cause problems with how much money you’ll actually see when you start claiming. If you keep an eye on inflation trends, you can predict any changes in your purchasing power and plan your retirement spending more accurately.

Long-Term Planning With Social Security

Instead of considering Social Security your only retirement income, consider it part of a bigger plan. Looking at the big picture will ensure you don’t run short later on. You’ll need to balance your sources of retirement income and think carefully about how to optimize each one so you can have a comfortable retirement.

Staying Informed on Social Security

But most of all, the best thing to do is to keep up with the latest Social Security rules and updates. After all, how can you expect to understand what to do with Social Security if you don’t know what’s happening? Pay close attention to any changes in the Cost of Living Adjustments (COLA) and any new Social Security rules.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About