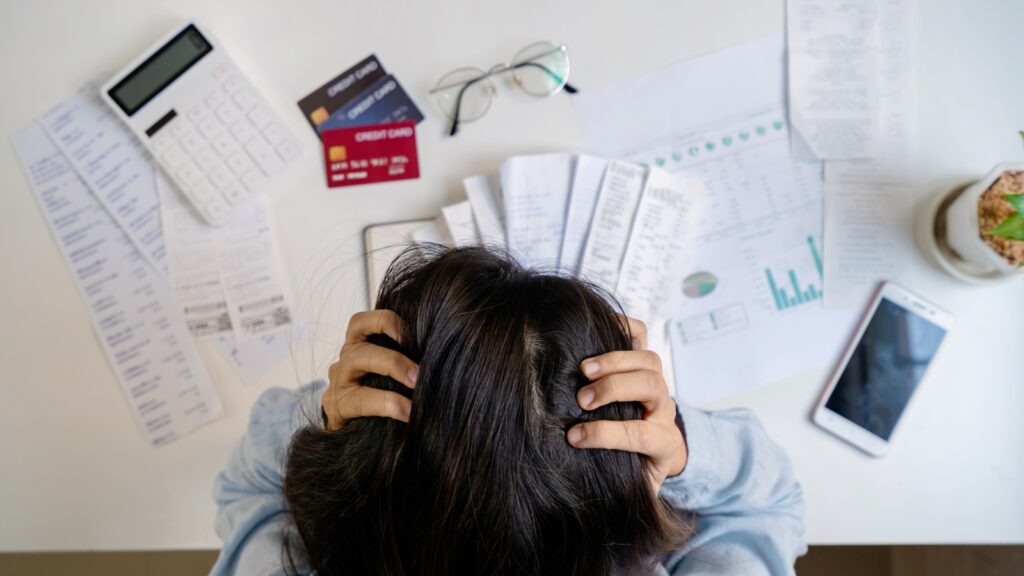

No matter your occupation or wage, there are some habits that will prevent you from optimizing your wealth. Whether you spend too much money on clothes, make bad investments, or have expensive hobbies, many things keep people poor.

Here are 21 habits that are keeping you poor.

Not Keeping Track of Expenses

Not keeping track of your expenses is a sure way of draining your income. Even small and innocent purchases can add up, and being frugal can be an excuse for you to spend money on more things. Consider using money-tracking apps to monitor your spending.

Impulsive Buying

Have you ever watched a TV ad and thought you needed whatever’s being advertised? Companies and brands will use call-to-action slogans in order to convince you that you need the latest gadget to optimize your life. Whether it’s an accessory for your car, the latest console, or else, people fall victim to their impulses frequently because of the way products are marketed.

Spending Money on Dates

Going on a date doesn’t have to be expensive. What happened to walks in the park? A drive through the country? Or just going to the cinema? People are under the assumption that dates need to take place in expensive restaurants, and the notion that you can’t split the bill drains one’s wallet more.

Alcohol

Whether you drink every night or only on weekends, alcohol is draining your wallet. Engaging in drinking every week for years and years is costing you thousands of dollars, and the price of alcohol in bars is consistently increasing. Not only that, consider how it has affected your productivity the following day.

Cigarettes

Cigarettes are becoming more and more expensive. Kicking that nicotine addiction will not only do wonders for your health but also for your wallet. Smoking a pack a day would lead to spending over $13,800 each year.

Expensive Coffee

Grabbing a coffee has become a common trend among office. Rather than opting for a coffee from the office kitchen, the act of going out and purchasing a tasty coffee is too tempting to some, despite how expensive they can be.

Going Without Insurance

While you think you may actually be saving money, this can cost you significantly in the long run. People assume that bad things and accidents won’t happen to them, and it’s only something that you hear about. But when they are hit with hospital bills or car repairs that they can’t afford, their wallets are in trouble.

Continually Taking on Debt

Continually taking on debt without the intention of repaying it is keeping people poor. Whether the person already has college debt, applying for a loan or a mortgage, it’s important to stay on top of your debt before it spirals out of control.

Expensive Tastes in Food

Eating out is a common habit which is keeping people poor. Rather than cooking a healthy and delicious meal at home, people are enthralled with the idea of going out. Whether it’s for the dining experience, socialising, or the feeling of being able to eat out, it’s a bad financial habit. Even the average American spends over than $2,500 a year on eating out.

Being a Fashionista

Being a fashionista is problematic because you’re constantly thinking about how you can upgrade your image. High end fashion brands are expensive, and fashionistas have trouble being satisfied with what they currently have in the wardrobe.

Not Setting Any Goals

Do you want a house, to invest, or are you saving up to start a business? It’s important to set financial goals in order to not only keep track of your finances but to motivate yourself. Your intrinsic motivation towards a tangible goal will elevate you to the next level of financial security and wealth.

Not Investing Your Money

Another mistake people make is leaving their money without investing. Money can decrease in value over time, so it’s wise to invest in something.

Making Risky Investments

However, making risky investments is a bold strategy. Fluctuations in the stock market can lead to significant losses. Whether you’re investing in stocks, shares, or else, it can be tricky knowing where to place your money.

Not Paying Yourself First

When you earn your salary, you should pay yourself first. For example, you should set aside 10% to 20% of your salary for you before paying anything else back. Then, you should allow yourself to pay back loans, debt, and so on.

Credit Card Debt

Obtaining a credit card can lead to significant spending because you don’t notice it initially. But this spending will add up in the long run.

Online Shopping

Online shopping is a quick way to squander your money. This is because purchasing things online from the comfort of your home doesn’t feel like buying anything. You don’t have to go to a store, lift your wallet, or interact with the cashier, making the online transaction seem almost fleeting.

Paying in Instalments

Paying in installments is another sneaky way to convince people that they can afford what they’re paying for. Often, people who pay in installments are those who cannot yet afford what they’re paying for.

Having Expensive Hobbies

Do you like playing golf? Rock climbing? Skiing? These hobbies may be keeping you poor. While it’s important to blow off steam and engage in things we’re passionate about, you shouldn’t let it predominate to the extent you’re spending the majority of your income on it.

Keeping Up With the Latest Trends

Keeping up with the latest trends can leave you feeling like you’re falling behind. How do you counter this? By investing in whatever’s hot. Whether it’s the new gaming console, the newest Gucci addition, or a new car, keeping up with others is a quick way to squander your money.

Only Focusing on Spending Less

Only spending less isn’t sufficient enough if you want to have more money. It may help you have the money to spend on something you want or need, but it won’t actually earn you any more money.

Not Setting Boundaries With Friends

Are your friends going to the bar or an expensive restaurant? Consider setting boundaries. Just because some people can afford to buy lobster and champagne, doesn’t mean that you can. Next time, consider saying no to your friend’s frivolous activities.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About