Keeping your bank account safe and sound is much more difficult than you think. After all, you wouldn’t want just anyone snooping through it or, heaven forbid, taking something out, would you? Here are 18 things you should never do with your bank account and why.

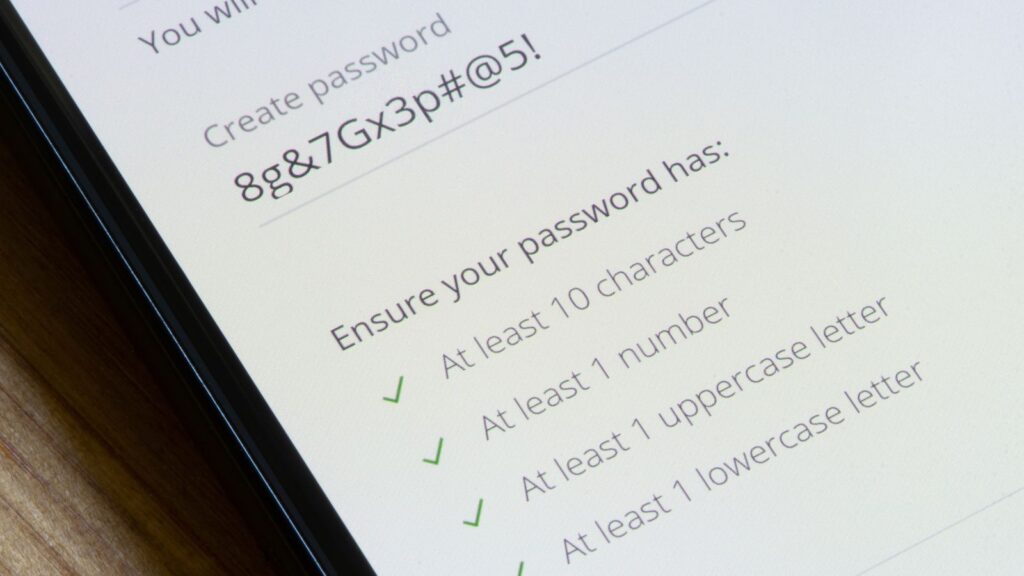

Skip the Simple Passwords

While it might be tempting to use your birthday or pet’s name for your banking password, that’s a big mistake. Pick a password that mixes letters, numbers, and symbols to keep your account safer. You don’t want any old hackers getting a look inside, do you?

Don’t Ignore Those Bank Alerts

Whenever you get those little emails or texts from your bank, don’t just swipe them away. Pay attention to them because alerts can inform you about money going out of your account or remind you about due bills. Staying informed with these updates is the only way to ensure you’re on top of everything.

Stop Overdrawing Your Account

If you find yourself dipping into the red more often than not, that’s a slippery slope. Going overdrawn costs you through overdraft fees and tells people that you’re not great at managing your cash. Keep an eye on what you spend, and make sure you’re not spending money that isn’t there.

Avoid Public Wi-Fi for Banking

You might think it’s okay to check your balance while sipping a latte at the cafe, but using public Wi-Fi for banking can be a huge mistake. You should always wait to use a secure and private connection before logging into your bank account. This way, you’ll avoid the headache of potential thieves getting into your account.

Keep Banking Personal

Similarly, you should use personal devices for your banking needs instead of shared devices, as logging into your accounts from other devices can increase the risk of security breaches. You know you’re safer when you only use your own device. Just make sure that your security software is up to date, too.

Keep Your PIN Private

Keep your bank PIN or password to yourself, even if the person is someone you can trust. The risks are too high, and if that information leaks, you might have to deal with unauthorized purchases or even full-blown identity theft. Keep this info under wraps and regularly update your passwords to stay ahead.

Don’t Put Off Financial Planning

You shouldn’t put off your financial planning because it’s essentially like leaving your future to chance. Start taking control of your money now by setting up a budget or savings plan so you can feel more comfortable knowing where you stand and also increase your savings. The sooner you start, the better off you’ll be.

Beware of Dodgy Apps

Avoid using any banking apps other than the official ones from your financial institution. While third-party apps might look convenient, using them can leave you vulnerable to scams, so always check an app is legitimate before you download it. You can do this by contacting your bank’s customer service or checking their official website.

Don’t Overload Your Checking Account

Avoid putting large sums of money in your checking account because this will not help your financial growth. Putting any extra funds into a savings or investment account will earn interest or investment returns. This will help you diversify your assets and improve your finances over time.

Read Your Monthly Statements

It’s worth reviewing your monthly bank statements because they’ll help you track your spending habits and identify unusual or fraudulent transactions. Depending on your finances, you’ll also be able to change your budget to suit your financial goals.

Pick Your ATMs Wisely

When you visit an ATM, make sure you only choose those in secure and open areas. ATMs in remote or poorly lit places are more likely to have skimming devices on them, which could cause you to lose a lot of money. Using ATMs in more secure locations means the risks of cash withdrawals are much lower.

Pay More Than the Minimum

If you’re in debt, try to pay more than just the minimum because this can seriously reduce the amount of overall interest and shorten the term of your debt whenever you can put any additional funds into your debt payments. You’ll save more money in the long run and ease your financial stress, too.

Don’t Share Banking Details Over Email

Never share sensitive banking details over email because it’s not a secure way to send sensitive information. Even if you’re talking to someone from the bank, it’s really not that difficult for cybercriminals to hack into your email and get your details. You’re much better off using more secure platforms or directly speaking to your bank through other communication options.

Use Credit Cards Online

When shopping online, you should try using credit cards because they’ll give you extra protection. Credit cards usually have better fraud protection than debit cards, so if you lose some money, it’ll be much faster for you to get it back. Plus, you’ve also got the chance to earn while you’re spending, thanks to cashback and reward systems.

Think Twice Before Co-Signing

Co-signing a loan is a big deal because you’re essentially covering the cost for something if the other person can’t. While it is a nice gesture, ensure you can handle that potential expense before signing on the dotted line. If things go wrong, being unable to pay could cause major problems for your credit and finances.

Update Your Info

Whenever you change your address or get a new phone number, make sure to update your bank info ASAP. After all, you don’t want to miss any important notices or risk your personal info going to the wrong place. Keep your bank in the loop with any changes in your life so you can keep your account secure.

Don’t Ignore Account Fees

Nobody likes surprise fees, so it’s a good idea to regularly check out your bank account’s fee structure. Banks can change their fee policies, such as what they charge for ATM withdrawals or account maintenance. If you stay updated, you’ll avoid unnecessary charges, which might even encourage you to find a better deal elsewhere.

Avoid Relying Solely on Contactless Payments

There’s no denying that contactless payments are convenient, but it’s smart not to rely solely on them. Sometimes, technology doesn’t work, or systems go down, so you should always carry at least one backup payment method. It doesn’t matter if it’s a bit of cash or a traditional credit card, just so long as you’ve got another way to pay.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About