You might think that deciding who gets your stuff after you’ve gone is straightforward, as you can just let your family sort it out. Unfortunately, the truth is anything but, as failing to write a will can cause all kinds of problems for your loved ones. Here are 18 things that can happen if you don’t put your final wishes on paper and how to avoid them.

The Government Decides

If you don’t write a will, you’re basically allowing the state to make the big choices for you. There are always people across the country who decide who inherits your stuff if you don’t make a will, and these laws might not line up with what you’d want. Do you really want some distant cousin inheriting your prized possessions? Probably not.

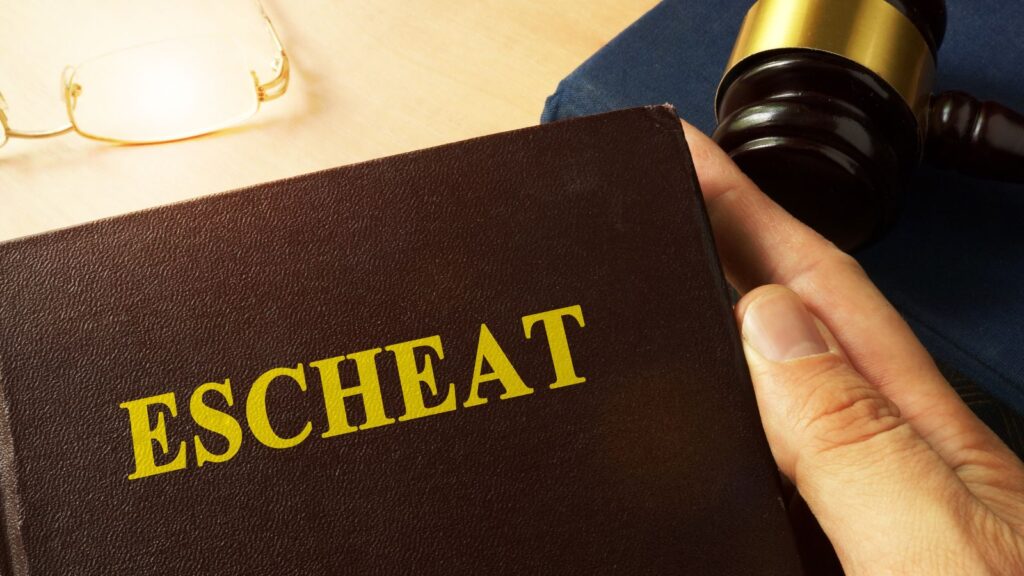

Going to the State

Worst of all, if nobody steps up as your heir, your assets could end up with the state. This is known as “escheatment,” and the only way to get around it is by writing a will. Only then will you make sure that your assets stay within your chosen circle to support people instead of government coffers. You wouldn’t believe how much property goes unclaimed.

Family Feuds

Nothing says “family drama,” like fighting over belongings when someone passes. Without a will, you’re creating the perfect ground for family arguments, or even full-blown feuds, among your relatives. Even the best family relationships can become a lot tenser when your inheritance is on the line, and writing a will makes everything a lot clearer.

Nothing For Unmarried Partners

Anyone who lives with you but doesn’t have a ring on their finger could end up with absolutely nothing. Most states only recognize relatives, and this means you’ll leave your significant other in the cold without a will. Although it’s time-consuming, writing a will is the best way to make sure they’re looked after.

Looking After the Kids

You’ll need to write a will if you have any kids under 18, as you’ll name a guardian to look after them. Without it, the courts decide who raises your children, and they could end up choosing someone you really don’t want to look after them. You know best when it comes to their welfare, so don’t leave this decision to strangers.

Educational Funds

Speaking of little ones, you can’t leave money for your kids or grandkids’ college funds without a will. You’ll need to make it clear that this money is used exactly for their education so they’ll have a bright future on your terms. This way, you’ll be able to invest in their potential, even from afar.

The Trouble With Taxes

Taxes might be a headache now, but they’re ten times worse for your heirs if there’s no will. They could face even bigger tax hikes and complicated issues when they’re settling your issue, so why not make it easier for them? Writing a will will sort these things out in advance and make the whole tax process a lot easier for everyone involved.

The Waiting Game

Without a will, your estate will go through probate, and this process can drag on for quite some time. It’ll delay when your heirs get their inheritance or even if they get anything. You should spare your family the wait by getting them their dues swiftly. And to do this, a will is the way to go.

Business Decisions

For any business owner, writing a will is an absolute must because, without one, you’re leaving its future up in the air. A will lets you plan who takes over to keep your pride and joy running smoothly. It’ll help them avoid any disruptions that could harm your business or even cause it to collapse.

Forgotten Charities

Without a will, those good intentions to leave a little to charity may never be realized. Writing a will means that people will remember the causes that are important to you, and it’ll make those causes official and binding. This way, your legacy of giving will continue even after you’ve gone and make a lasting impact, too.

Sentimental Value

We all have those special items that mean the world to us but might not be worth much to anyone else. Without a will, who knows where they’ll end up? You need to make sure your treasured items go to someone who will appreciate them as much as you do by mentioning them.

Lots of Legal Fees

Setting an estate without a will often costs a lot more in legal fees, which can chip away at what you leave behind. A straightforward will can cut down on these expenses and give your descendants a little extra. Better yet, it’ll reduce the stress and time they’ll spend on legal proceedings, which is priceless.

Your Digital Life

We spend most of our time online, so you can’t forget about your digital life when you’re gone. Without a will, sorting out your digital assets becomes a lot harder and a lot messier. You should include details about what should happen to your digital life in your will so you can save your family from a major headache.

Missing Out on Money

You might have money or a family heirloom that you want someone specific to receive. What’s the best way to do this? You guessed it, with a will. Writing one means that everyone you care about, near or far, will get a piece of your legacy, and it’ll stop any lawyers from having to make any guesses about assets.

The Heir Hunters

If you don’t write a will, professional heir hunters may have to step in to find distant relatives who can claim your estate, and they’ll usually take a cut for their services. Naming your heirs will mean you can avoid these middlemen and keep your estate with the people you’ve chosen. It’ll also keep strangers from profiting from your legacy.

Debt Drama

Any joint debts you have could fall directly on your loved one’s shoulders, whether that’s through a co-signed loan or a shared credit line. You can use your will to make it clear how the courts should manage your debts, and this will shield your loved ones from any unexpected financial issues. After all, you can’t put a price on peace of mind.

She’s Taking the Dog

Most of us see our pets as part of the family, but without a will, there’s no plan for who’s going to take care of them. To make sure they’re well looked after, you’ll need to appoint a caretaker in your will. It’s the only way you can guarantee that they’ll be looked after by someone who loves them as much as you do.

Legacy in Limbo

Aside from all the money and possessions, your legacy tells people how you should be remembered. If you don’t write a will, you can’t choose what happens with your story or your values. It doesn’t matter if it’s through charitable donations or the stories they’ll tell at your memorial because a will lets you decide how you’re remembered.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About