Almost every country in the world has some kind of debt to pay, but some of them manage it better than others. The lower the debt-to-GDP ratio, the easier it will be for this country to pay back these debts. Unfortunately, some countries are deeper in the red than others, and we’re looking at 18 of the countries with the highest debt-to-GDP ratio.

Japan

This data comes from research by World Population Review. At the top of the list is Japan, with a debt-to-GDP ratio of 264%. This is mostly because the Japanese government has been trying to fix the economy with lots of spending following years of economic issues. Eventually, all that debt piled up, resulting in this huge ratio.

Venezuela

Next on the list is Venezuela, with a rate of 241%, which is a result of increasing inflation and ongoing political issues. The nation’s economy isn’t doing too well either, and this has made their extreme debt just one of the many financial challenges the people are facing. Unfortunately, it doesn’t look like they’ll fix these issues any time soon.

Sudan

Sudan’s not doing too well either, as it has a debt ratio of 186%. The nation’s long-standing conflicts and economic problems have left their mark and made it difficult for the country to get back on its feet financially. Since the country doesn’t have access to international financial markets, it can’t grow or develop, either.

Greece

Greece’s economic problems from several years ago are still causing problems for the country, as it has a debt-to-GDP ratio of 173%. The government has tried to fix things with spending cuts and tax hikes, but they don’t seem to be working. Economic recovery is slow, and the financial system is under a lot of strain, which is causing all kinds of issues for the Greek people and the economy.

Singapore

Singapore’s debt ratio is 168%, although this isn’t necessarily a bad thing. The Singaporean government has used its debt to invest in infrastructure to keep its economy going. They’ve been focusing on the economy in the long term, and that includes taking on debts to encourage more growth.

Eritrea

Political isolation and limited access to the market have made life difficult for Eritrea, which is why it has a debt-to-GDP ratio of 164%. It has many infrastructure and development needs, which require huge investments. Unfortunately, its economy just can’t support this at the moment.

Lebanon

With a debt-to-GDP ratio of 151%, Lebanon is in a difficult situation. This is mostly because of the government’s economic mismanagement and political instability, alongside regional conflict. These issues have caused increased borrowing, which has made things worse for public finances and stopped the government from investing in public services.

Italy

Despite its rich history and culture, Italy is struggling economically at the moment, with a 142% debt ratio. The government is struggling with slow growth and political problems, which doesn’t make handling debt any easier. They are trying to reduce this debt load, but unfortunately, it seems to be a losing battle.

United States

This one might surprise you, as America has a debt-to-GDP ratio of 129%, even though it has such a huge economy. The issue comes from managing that wealth wisely, which some governments have been able to do. Borrowing at low interest rates helps the government to manage this debt so it can support spending on other things.

Cape Verde

Island life isn’t all sunshine and beaches, and Cape Verde is a prime example of that. It has a debt ratio of 127%, which shows that relying so much on tourism isn’t the best idea when there are global financial issues. Since fewer people traveled during the pandemic, it became a lot harder for the island nation to manage its economy.

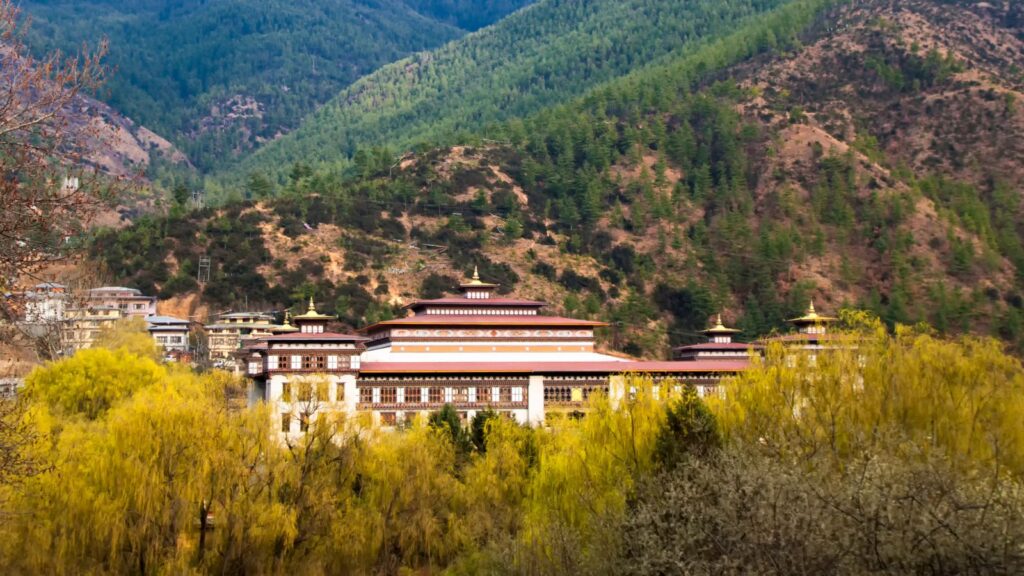

Bhutan

Bhutan’s debt ratio is 125%, which is mostly because the government has borrowed a lot of money to fund huge hydropower projects. It hopes to sell clean energy to its neighbors and pay off this investment big time down the road. If it works, this could gradually reduce the nation’s debt burden by quite a bit.

Bahrain

The government of Bahrain has invested a lot of money into its infrastructure projects because it’s trying to move beyond being just an oil-producing nation. They want to create more sustainable sources of income for the nation’s economy. This has meant that the country has a debt ratio of 120%.

Sri Lanka

Sri Lanka’s economy has been going through a tough time lately, and that includes defaulting on its 114% debt ratio. There has also been a currency shortage, which has meant the country needs to fix its economy quickly. They’ve also turned to the international community for help in dealing with these issues.

France

France has a 112% debt-to-GDP ratio, which comes from the government pumping money into social services and infrastructure. The government is trying to give the French people an above-average quality of life, which has naturally caused more expenses. Even with these issues, France is maintaining its strong welfare programs and public investment.

Spain

Like its French neighbor, Spain also has a 112% debt ratio and some economic problems. The government has created reforms and changed policies to help balance the Spanish economy, which includes getting support from its European allies. The Spanish government is trying hard to fix the economic factors that will help improve its economy.

Portugal

Likewise, Portugal has a debt-to-GDP ratio of 112%, which is a result of similar economic problems. The main focus of the Portuguese government is to improve tourism in the country and improve markets so they can reduce debt. They’re desperately trying to grow the economy, but only time will tell if this works.

Canada

Canada’s debt-to-GDP ratio is 107%, which comes from the government’s consistent economic policies and strong international relationships. Canada has managed its finances better than some other countries on this list, and it’s trying to encourage economic growth through trade. This way, its finances stay strong, even with that high debt.

Belgium

At 104%, Belgium is another European country with a hefty debt-to-GDP ratio. This comes from the nation investing money to improve living standards through social welfare programs and public services. Although the national debt is rising, the government wants to make sure its citizens’ well-being stays strong.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About