Recognizing one’s own financial security in comparison to the rest of the population might provide a new perspective and feelings of gratitude in an economy marked by a significant rich/poor gap. Here are 18 signs that you’re financially fortunate and better off than the typical American.

You Haven’t Got Any Credit Card Debt

The average American household has $6,000 in credit card debt with monthly payments and rising interest rates. If you are able to pay off your balance in full each month, or if you rarely use a credit card, you’re among the fortunate few who have avoided credit card debt.

You Have an Emergency Fund

Financial gurus frequently recommend maintaining an emergency fund that can cover three to six months of living expenses. But more than half of Americans haven’t got even three months of emergency funds saved. If your funds comfortably exceed this level, you have a safety net against unexpected events that most Americans would desire.

You Have Made Retirement Contributions

Regular contributions to a retirement account show a strong sense of financial stability. In fact, about half of all American households did not have any retirement savings in 2022. If you’re fortunate enough to have maxed out the annual limitations for your IRA or 401K, your golden years will be far more comfortable than those of a typical individual.

You Own Your Home

There’s nothing quite like the sweet feeling of walking through your own front door without worrying about rent spikes or a landlord’s whims. If you’ve got a mortgage or own your home outright, you’re already ahead of the game.

You Have Passive Income Streams

Ever heard the phrase “make your money work for you”? If you’ve got passive income flowing in from investments, rental properties, or other ventures, you’re not just clocking in for a paycheck, you’re letting your money hustle for you.

You’re Not Living Paycheck to Paycheck

Say goodbye to those nail-biting moments before payday. If your bank account isn’t running on fumes by the end of the month, you’re in a better position than many.

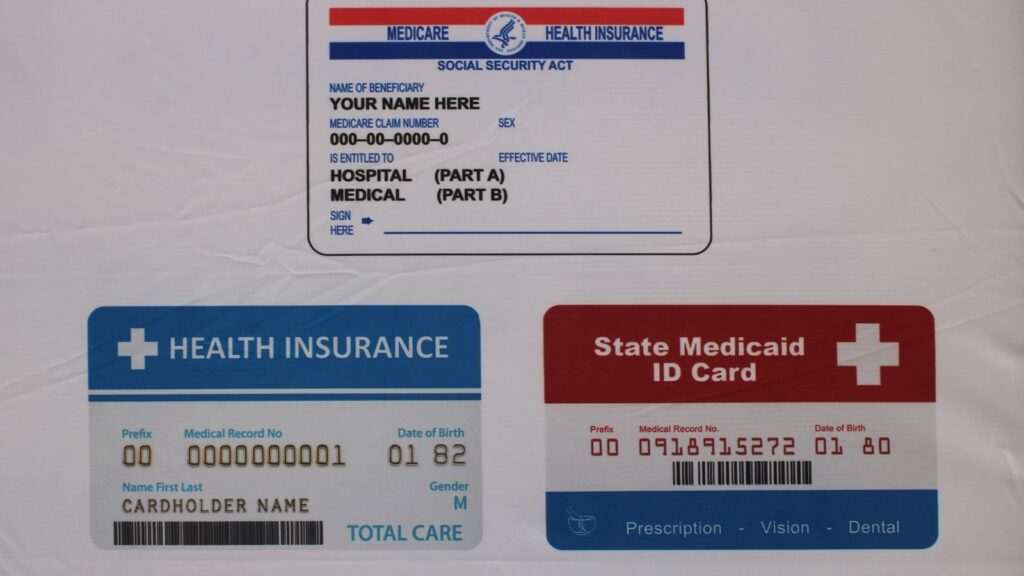

You Have Health Insurance

Doctor’s visits without the dreaded bill shock? Check. Having health insurance means you’re not just taking care of yourself but also protecting your finances from unexpected medical expenses.

You Travel for Pleasure

Packing your bags and jetting off for a getaway isn’t just a dream, it’s a regular occurrence. If you’re able to travel for fun without breaking the bank, you’re definitely in a comfortable financial situation.

Grocery Prices Aren’t a Concern

Ever get to the checkout and have to put something back because it’s just too pricey? If you’re not sweating over grocery bills, it’s a sign that your wallet’s in a happy place.

You Have Other Investments

Having different investments, whether in stocks, bonds, real estate, or cryptocurrency, ensures that you are not putting all of your eggs in one basket. It’s a wise decision for accumulating long-term wealth and weathering financial storms.

You Own Your Own Car

Owning a vehicle, especially a new one, without the expense of a high-interest loan or lease shows exceptional financial stability. No more relying on public transport or worrying about rental costs. When you have your own vehicle, the world is your oyster. Whether you’re commuting to work, conducting errands, or going on a road trip, having a car allows you to drive wherever you want, whenever.

You Have Life Insurance

Planning for the future entails more than just deciding what to do with your money; it also includes protecting your loved ones. Life insurance isn’t just for the wealthy, it’s a wise decision for anyone who wants to ensure financial security for their family. Whether it’s covering funeral costs, paying off debts, or replacing lost income, life insurance ensures that your loved ones are cared for even if you’re not around.

You Have Professional Financial Advice

If you can afford to hire someone to teach you how to manage and invest your money, you probably have more than a few dollars to spare. But hiring the services of a financial advisor for personalized suggestions may seem ludicrous to the average American, who struggles to buy essentials.

You Don’t Have to Rely on Payday Loans

If you never have to use more risky lending options, such as payday loans or cash advances, you’re probably financially secure enough to cover unforeseen expenses and purchases. Many people in America rely on such services to stretch their resources during difficult times, which increases stress.

You Have a Good Credit Score

An outstanding credit score is an indicator of long-term wealth and suggests a track record of timely repayments and appropriate credit use, while also providing access to the best financial products. Americans who have suffered from debt lack this edge, and they are frequently caught in a cycle of high-interest bills and bad credit scores.

You Haven’t Got Any Medical Debt

Whether it’s staying on top of your health insurance coverage or paying medical bills like a pro you’ve avoided the financial traps that often come with illness or accidents. So, while others are worried about how to pay off those large medical bills, you can rest easy knowing that your financial situation is in excellent shape.

You Can Turn Down Work

If you are able to turn away money-making opportunities without fear of the consequences, you’re in the financial minority. Many people don’t have the luxury of being able to decline extra work or employment that doesn’t align with their interests.

You Work to Your Own Schedule

Having freedom over your work hours or the ability to work remotely demonstrates that you are respected in your industry and have achieved a degree of financial security. Many employees are completely at the mercy of their employers, with little ability to change their schedules for their convenience.

19 Grim Realities of Dating After 50 That Are Often Overlooked

19 Grim Realities of Dating After 50 That Are Often Overlooked

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

26 Things That Will Be Extinct Because Millennials Refuse to Buy Them

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

24 Outdated Slang Terms You Absolutely Shouldn’t Be Using Anymore

25 Hardest Parts About Getting Older That No One Ever Talks About

25 Hardest Parts About Getting Older That No One Ever Talks About